Flash Freeze Bullshit

TODAY THIS IS A WARNING TO YOU!

Nasdaq officials say a "connectivity" problem was what shut down trading for three hours this Thursday, but some cybersecurity experts are concerned that hackers may see an opportunity to attack the markets.

"This draws attention to a system that we know," said Alex McGeorge, a senior security researcher at Immunity Inc. "Even if this wasn't a malicious attack, this has some redundancy issues—meaning it is probably ripe for having some other types of security vulnerabilities."

I CALL BULLSHIT ON THIS...... HERE IS WHY!

Now I am not an expert on computers, I never have been and probably never will be, however over the years what I spend alot of my time doing is

spotting trends, patterns and overall consistencies in the market that tend to REPEAT themselves both on the market and off the market also.

On this occasion I could not help myself but look over some of the notes I had right before the 2008 crash. Yes back in around 2006 - 2007 I remember I wrote down how secure they were saying the local markets and new upgrades to software and local electrical tickers meant there was more security and less chance of breakdowns and exposure to hackers who could exploit bugs and manipulate any part of the system. I remember a few weeks later after this news was released the market had to shut down for a day or so due to technical glitches.

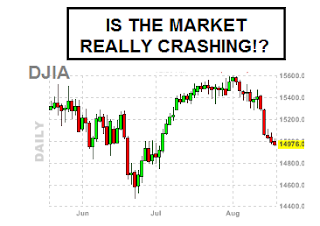

Even here in 2013, in a time where computers are suppose to be extremely advanced we still had the NASDAQ market close down a few hours due to technical glitches. Is this amazing? no? Shocking...... definitely not! but I do see these same patterns forming before we had major problems on the market!

I remember there being major glitches, followed by extremely bad problems in the housing and sub prime markets, and then the market soon topped out, and we experienced a major crash in 2008 that wiped out many traders, funds, institutes, 401k's pension funds and all the rest. It was a horrific event!!! But here is the scary and strange coincidence about the 2008 crash and what is happening right now in 2013.

THE SCARY ELEMENT HERE - HISTORY REPEATS

The scary thing for me right now is that history seems to be playing out pretty nicely and not a soul is out there seeing this secret little world that I call

"deconstructing history". I think there is a warning sign in it for us all. So I will try my best to explain how I think history is repeating.

We are having the slight signals the market is experiencing technical glitches the same as what we had back in 2006. My guess is that they were setting up a market crash years in advance and they needed some sort of scapegoat to blame incase their controlled sell off did not work, or did work. Soon after the sub prime markets imploded the market topped and we crashed at the end of 2008 and even into 2009.

Fast forward to today, and now we have all these computer glitch problems, and again I think they are getting warmed up for another controlled sell off or crash type scenario on the market, and again they need a back up or something that they can use as a scapegoat!

Here is where things really get interesting....

If they are planning another controlled sell off, and I said IF, you have to remember we are seeing a massive QE or stimulus program where the government has been throwing money out of thin air back into the market to help keep it propped up. Again this is similar to the massive property boom, and subprime boosting that lifted the markets back in the mid 2000's. Back then, this was a ridiculous situation where almost anyone could get a low doc loan and buy a house. Eventually that was doomed from day one, and when the subprime markets imploded the markets did too, badly. I mean people have still not recovered financially from that one.

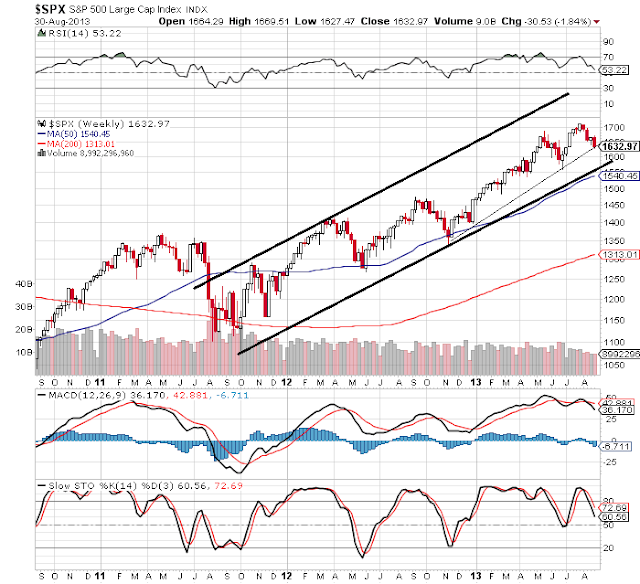

Right now the markets are at all time highs, the government are now thinking about tapering back all this QE money out of thin air they keep printing and throwing on the market. Again this Quantitative Easing Program was doomed from day one, just like the subprime was doomed the very first day it was bought in. Stay with me here.......

There is a bullishness in the air amongst traders too. Yesterday I visited a forum in which traders are getting almost cocky that the stock market will never come down again. I chuckled to myself because I have been watching the markets over half my life and realize that about

every 7 years the market experiences very bad sell off's and even crashes if you want to call it that. Over the last 20 - 30 years it has been working like clockwork. It is a cycle I have noted and its freakish how often this occurs. That cycle comes to an end next year in 2014. OH DEAR! Do you now see how all this is starting to add up.

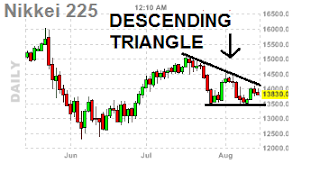

So with the computer glitches, all these rumors of QE tapering, and the market booming to fresh new highs, is all setting up like the pattern in 2006 - 2007 where the market topped out and we crashed the year after. I am not saying to panic just yet, because these signs are a leading suggestion that something is definitely in the works. Now I could be wrong, but this is something I thought of today and wanted to post just because I thought the time was right! And because my readers have been asking for a fresh new longer term view of what the market will do in the next few years.

I hate to bust peoples bubble, but right now if history keeps repeating we are looking at a MAJOR market event coming in the next few years. It is silly to put a date on it, because it will not happen tomorrow, but in the next few years looking at how things are repeating something BIG is coming. An event, similar to the 2008 crash, and an event that not many people were ready for. I think the big events to watch are an implosion in the derivatives markets, which I think is very near, and also massive tapering by the FED. Once they start taking away massive amounts of MONTHLY stimulus, the market is not only in trouble, its going to cause what I say

A PURE "SHIT STORM" THAT WE HAVE NOT SEEN BEFORE! Sorry if the colorful language offends anyone, but this is the best way I can describe it, and the best way I can explain how history is repeating and to warn others out there.

Please pass this article onto others and warn them!. They might be the ones to thank you for it later.

WHAT IF YOU KNEW

WHICH WAY THE MARKET WAS ABOUT TO MOVE BEFORE IT HAPPENED? CLICK HERE To Join Our VIP ELITE GROUP -- FREE!

Powered by |